Hedge money, recognized for their intense expense tactics, are presently navigating a tumultuous market place landscape characterized by heightened volatility. This environment has posed major difficulties, compelling fund supervisors to reassess their techniques. Notably, the prominence of short positions has come to the forefront, specifically with shares like AMC and GameStop, that have skilled dramatic value fluctuations driven by retail Trader enthusiasm. These developments underscore the complexities hedge resources face since they harmony threat and option inside of a rapidly shifting current market. The implications for traders are profound, as being the tactics utilized by hedge funds can noticeably impact marketplace dynamics and particular person financial investment outcomes. As we delve further into this subject matter, We're going to discover how these challenges form the hedge fund business and whatever they signify for investors planning to navigate this unpredictable terrain efficiently.

the latest marketplace downturns have elevated major considerations concerning the balance of hedge funds, as these resources typically utilize substantial-hazard tactics that can be seriously impacted by sudden declines in asset values. The volatility witnessed inside the marketplaces has led to elevated scrutiny of hedge fund overall performance, with several buyers questioning the resilience of their portfolios. probable liquidations pose an important menace, as forced offering of belongings can even more depress price ranges, making a vicious cycle that undermines fund security. This situation not merely has an effect on the cash on their own and also has broader implications for the marketplace, as substantial-scale liquidations can lead to heightened volatility and uncertainty. As hedge resources grapple with these worries, the interplay in between industry dips and volatility gets to be significantly essential, highlighting the need for adaptive methods to safeguard investments and retain Trader self esteem in an unpredictable economical landscape.

shares like AMC and GameStop have emerged as focal details for both retail and institutional investors, capturing prevalent consideration due to their Serious price fluctuations. These shares have become emblematic from the battle in between retail traders and hedge funds, specially as retail buyers have rallied all over them, driving costs to unparalleled amounts. The volatility affiliated with these shares has experienced major repercussions for hedge funds, many of which held significant short positions, betting in opposition to their achievements. As price ranges soared, these funds faced mounting losses, forcing some to protect their shorts at a decline, additional fueling the upward momentum. this example highlights the inherent dangers hedge money encounter when participating Briefly advertising, specifically in a marketplace where by retail sentiment can considerably change stock valuations. the continued saga of AMC and GameStop serves being a cautionary tale about the unpredictable nature of investing in a volatile environment.

Margin calls arise when the value of an Trader's margin account falls beneath the broker's necessary bare minimum, prompting the necessity For added resources or perhaps the liquidation of belongings. For hedge money, margin phone calls can have critical implications, since they normally function with elevated leverage to amplify returns. historic examples, including the collapse of Aros, illustrate the devastating consequences of margin calls, the place money ended up compelled to liquidate positions at unfavorable price ranges, resulting in considerable losses. Elevated leverage stages raise the likelihood of forced liquidations, specifically in risky markets exactly where asset values can fluctuate dramatically. When hedge resources are unable to satisfy margin needs, They might be compelled to market off property immediately, exacerbating market declines and even more impacting their portfolios. This cycle of compelled liquidations don't just threatens The soundness of specific funds but can also lead to broader current market instability, highlighting the pitfalls associated with large leverage in hedge fund functions.

The possible for brief squeezes poses an important hazard for hedge funds, particularly when unexpected rate increases come about in seriously shorted shares. When selling prices rise sharply, hedge resources which have guess from these stocks could possibly be pressured to go over their small positions to limit losses, normally leading to more value escalations. This dynamic can produce a comments loop, wherever the need to acquire back again shares drives charges even bigger. Retail investors have increasingly coordinated endeavours to initiate limited squeezes, as seen inside the cases of AMC and GameStop, demonstrating their capability to affect marketplace actions and challenge institutional buyers. The implications of these types of coordinated steps can be profound, resulting in considerable losses for hedge resources caught during the squeeze. In addition, the unpredictable character of intensely shorted stocks all through market downturns adds Yet another layer of complexity, as volatility can exacerbate the hazards related to small promoting, leaving hedge cash vulnerable to fast and unforeseen rate shifts.

Mumu is excited to introduce an enticing advertising supply for new customers, delivering the opportunity to get up to five totally free shares upon signing up. This promotion not simply serves as an amazing incentive to join the platform but will also lets customers to kickstart their investment decision journey with beneficial belongings suitable from the amc ftd, start. Mumu boosts buyers' portfolios by offering a diverse array of investment possibilities, coupled with aggressive interest costs which will help develop their prosperity eventually. having a user-pleasant interface and sturdy applications for monitoring investments, Mumu empowers individuals to create knowledgeable decisions and enhance their monetary tactics. This is a excellent moment for likely traders to seize the opportunity and reap the benefits of Mumu's promotional give, setting the stage for An effective expenditure encounter. Don’t miss out on this chance to improve your portfolio and embark on the economic journey with Mumu!

Hedge money are more and more shifting to choices trading strategies, as this solution lets them to leverage funds much more competently when taking care of hazard publicity. By utilizing alternatives, hedge money can build tailored investment techniques that increase returns without having necessitating major capital outlay. nonetheless, this shift also raises potential pitfalls for retail investors who could try and follow hedge fund techniques without having totally knowing the complexities involved. Options trading is usually intricate, and missteps can result in substantial losses, significantly in unstable markets. thus, it truly is critical for retail investors to grasp the basics of choices buying and selling ahead of diving in, as being the dynamics of those instruments can significantly effects expense outcomes. in the risky marketplace, knowing possibilities trading turns into all the more essential, since it can offer options for hedging in opposition to downturns or capitalizing on cost actions. As hedge funds embrace these techniques, retail investors have to technique them with warning and knowledgeable Perception.

GameStop's recent monetary position displays noteworthy enhancements, notably in its monetary metrics and funds reserves, which have strengthened in latest quarters. the corporate has built strides in lessening personal debt and boosting liquidity, positioning by itself much more favorably inside a aggressive retail landscape. As GameStop prepares to launch its impending quarterly effects, these figures will be very important in shaping investor sentiment. good earnings reviews could bolster assurance amid both of those institutional and retail traders, signaling a possible turnaround for the organization. In addition, the increasing fascination while in the gaming sector and GameStop's strategic initiatives to diversify its choices may well catch the attention of more expenditure. These developments could generate a good setting for renewed curiosity during the stock, as traders try to find prospects in a business that has demonstrated resilience and adaptability. Overall, GameStop's financial advancements as well as anticipation encompassing its quarterly effects could pave just how for a more optimistic outlook among the investors.

Renaissance Technologies, a outstanding hedge fund known for its quantitative buying and selling approaches, has taken a careful however strategic technique concerning its involvement with AMC and GameStop. a short while ago, the firm has enhanced its share positions in these heavily shorted stocks, signaling a potential shift in its investment decision approach. This move raises the potential of a brief squeeze, as the combination of Renaissance's obtaining power and the prevailing substantial small desire could develop upward force on inventory price ranges. this type of situation could lead to sizeable current market volatility, impacting the two retail and institutional investors. The implications of Renaissance's investments are profound, as their actions might affect market place sentiment and investing dynamics. As market individuals closely keep an eye on these developments, the interplay between Renaissance's methods along with the broader current market could shape investment selections and highlight the continuing complexities of buying and selling in volatile environments like Those people surrounding AMC and GameStop.

The involvement of latest institutional buyers, which include Madrick funds and Discovery funds, has substantially impacted AMC's stock overall performance, bringing renewed consideration and believability to the corporate. Their investment signifies self-assurance in AMC's probable for Restoration and growth, which could positively influence sector sentiment. These firms often use strategic strategies that could enrich AMC's operational abilities, including optimizing monetary management and exploring modern business enterprise products. By leveraging their skills and methods, these institutional buyers may enable AMC navigate difficulties and capitalize on emerging opportunities within the leisure sector. In addition, the existence of institutional traders can bring in further desire from other sector members, creating a ripple outcome that bolsters Trader self-assurance. As AMC continues to adapt to changing industry problems, the backing of founded institutional buyers could Participate in an important position in shaping its foreseeable future trajectory and stabilizing its inventory effectiveness amidst ongoing volatility.

In summary, the dialogue highlighted quite a few essential points concerning hedge money as well as their effects available on the market, particularly the numerous threats they facial area in unstable environments. Hedge resources typically make use of significant-leverage approaches, building them prone to sudden market place shifts, which may lead to margin phone calls and compelled liquidations. Also, the increase of retail buyers as well as possible for short squeezes have even more complex the landscape for these cash. As we navigate these complexities, It is essential for investors to remain informed about market place tendencies as well as evolving techniques of hedge resources. We inspire you to subscribe For additional insights and updates on these vital matters. Your engagement is effective, so you should share your thoughts and ordeals from the feedback under. Allow’s foster a community of knowledgeable investors who will navigate the troubles and alternatives introduced by right now’s dynamic marketplace.

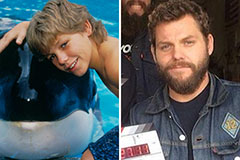

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!